Top 200+ gift to parents income tax

Details images of gift to parents income tax by website toyotabienhoa.edu.vn compilation. Income Tax on Gift Rules in Hindi | Income Tax on Gift Received from Parents Reletives Property Gift – YouTube. Gifts to Employees – Taxable Income or Nontaxable Gift. Rules for Overseas Money Transfer to Family Members Abroad | Unimoni.in. Gifts received in professional capacity are taxable

Free Gift Affidavit: Make & Download – Rocket Lawyer – #1

Free Gift Affidavit: Make & Download – Rocket Lawyer – #1

Section 64 Of The Income Tax Act: Clubbing Of Income And Eligibility – #2

Section 64 Of The Income Tax Act: Clubbing Of Income And Eligibility – #2

Should I Include a Dependent’s Income on My Tax Return? – TurboTax Tax Tips & Videos – #3

Should I Include a Dependent’s Income on My Tax Return? – TurboTax Tax Tips & Videos – #3

How Much is the Gift Tax? | What is a Gift Tax? | Gift Tax Limit 2020 – #4

How Much is the Gift Tax? | What is a Gift Tax? | Gift Tax Limit 2020 – #4

I received gifts during my wedding, are they taxable? – #5

I received gifts during my wedding, are they taxable? – #5

Benefits of Irrevocable Gift Trusts | Surprenant & Beneski, PC – #6

Benefits of Irrevocable Gift Trusts | Surprenant & Beneski, PC – #6

How Does a Uniform Gifts to Minors Act (UGMA) Account Work? – #7

How Does a Uniform Gifts to Minors Act (UGMA) Account Work? – #7

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #8

Gift Tax Limits in 2024: Exclusion Increase | Britannica Money – #8

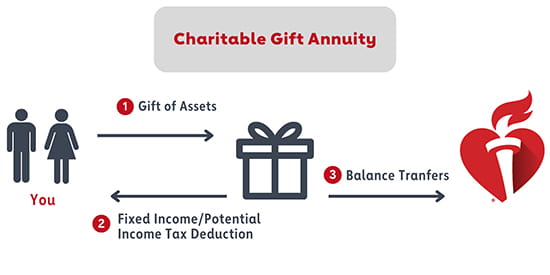

Charitable Gift Annuities | American Heart Association – #9

Charitable Gift Annuities | American Heart Association – #9

Kartik Jhaveri on X: “Make your child a millionaire… Do your usual tax planning & gift your child Rs. 2.21 crore at age of 21 tax-free! https://t.co/26XL6N9G8N” / X – #10

Kartik Jhaveri on X: “Make your child a millionaire… Do your usual tax planning & gift your child Rs. 2.21 crore at age of 21 tax-free! https://t.co/26XL6N9G8N” / X – #10

taxes – How gifting money to Parents helps in Tax saving in India? – Personal Finance & Money Stack Exchange – #11

taxes – How gifting money to Parents helps in Tax saving in India? – Personal Finance & Money Stack Exchange – #11

ITR : Disclosure and taxation of gifts received from brother? | Mint – #12

ITR : Disclosure and taxation of gifts received from brother? | Mint – #12

Tax Talk: Diwali gift from a business associate could be taxable – Income Tax News | The Financial Express – #13

Tax Talk: Diwali gift from a business associate could be taxable – Income Tax News | The Financial Express – #13

Is there any gift tax to be paid in USA on the amounts received from sale of my house and jewellery in India and sent to our daughter in USA? – Quora – #14

Is there any gift tax to be paid in USA on the amounts received from sale of my house and jewellery in India and sent to our daughter in USA? – Quora – #14

Do You Have to Pay Tax on Gifts? – #15

Do You Have to Pay Tax on Gifts? – #15

Publication 929 (2021), Tax Rules for Children and Dependents | Internal Revenue Service – #16

Publication 929 (2021), Tax Rules for Children and Dependents | Internal Revenue Service – #16

Federal Gift Tax vs. California Inheritance Tax – #17

Federal Gift Tax vs. California Inheritance Tax – #17

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #18

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #18

How Passing Assets to Parents Can Lower Taxes | Charles Schwab – #19

How Passing Assets to Parents Can Lower Taxes | Charles Schwab – #19

Income Tax on Gift | Relative से पैसा लेने से पहले यह video ज़रूर देखना | Cash Gift Tax Rule 2023 – YouTube – #20

Income Tax on Gift | Relative से पैसा लेने से पहले यह video ज़रूर देखना | Cash Gift Tax Rule 2023 – YouTube – #20

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #21

Gift Deed Registration: Stamp Duty, Registry Fee, Tax, Procedure – #21

Types of Tax – Exemptions, Due Dates & Penalties – #22

Types of Tax – Exemptions, Due Dates & Penalties – #22

A Guide To Gifts Of Equity | Rocket Mortgage – #23

A Guide To Gifts Of Equity | Rocket Mortgage – #23

Taxation on gifts: Everything you need to know | Tax Hacks – #24

Taxation on gifts: Everything you need to know | Tax Hacks – #24

Want To Gift Ancestral Gold To Your Kin Or Sell It For Cash? Know The Taxation – #25

Want To Gift Ancestral Gold To Your Kin Or Sell It For Cash? Know The Taxation – #25

Decoding wedding gift taxation in India: Know ways to exempt it – #26

Decoding wedding gift taxation in India: Know ways to exempt it – #26

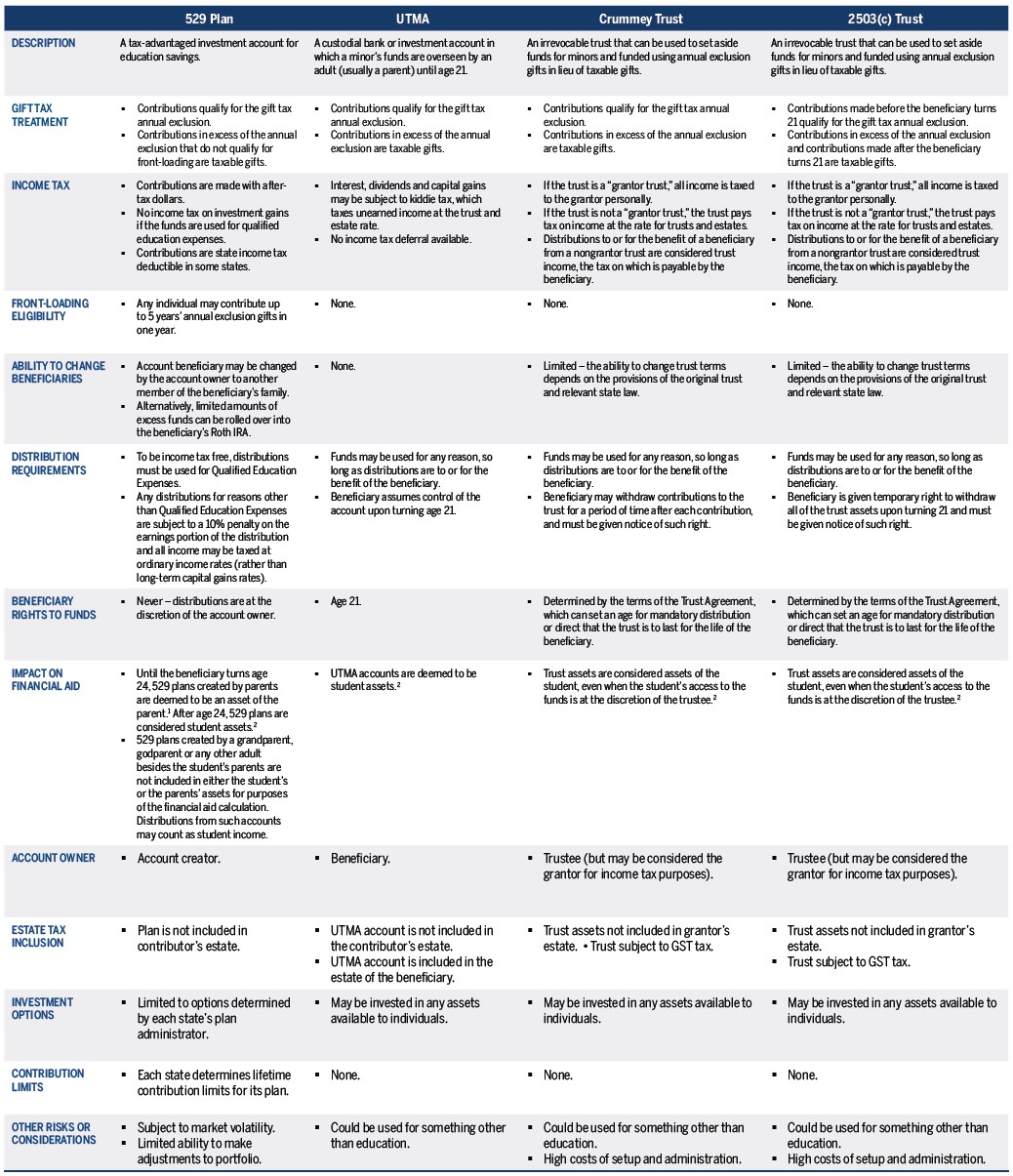

Publication 970 (2023), Tax Benefits for Education | Internal Revenue Service – #27

Publication 970 (2023), Tax Benefits for Education | Internal Revenue Service – #27

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #28

Income Tax Exemption On Gifts | Are The Gifts Above Rs 50,000 Taxable? | Personal Finance – YouTube – #28

gift to parents taxation Archives | Tax Jankari – #29

gift to parents taxation Archives | Tax Jankari – #29

-Gifts.jpg) Filing Income Tax Returns for Minors – TaxReturnWala – #30

Filing Income Tax Returns for Minors – TaxReturnWala – #30

William H. Parr & Company, LLP | Accountant | Darien – #31

William H. Parr & Company, LLP | Accountant | Darien – #31

A primer on how the IRS gift-tax law pertains to parents and their children – The Washington Post – #32

A primer on how the IRS gift-tax law pertains to parents and their children – The Washington Post – #32

Is There Gift Tax If I Give My Niece Money for Her IRA? | Money – #33

Is There Gift Tax If I Give My Niece Money for Her IRA? | Money – #33

![Income Tax Deductions under Section 10 [2024] Income Tax Deductions under Section 10 [2024]](https://pioneerone.in/wp-content/uploads/2022/06/tax-img-555x579xc.jpg) Income Tax Deductions under Section 10 [2024] – #34

Income Tax Deductions under Section 10 [2024] – #34

Gift Tax 101: Gift Tax Limits (+ Rules for Gifting Stocks) – #35

Gift Tax 101: Gift Tax Limits (+ Rules for Gifting Stocks) – #35

Income Tax on Gift Rules in Hindi | Income Tax on Gift Received from Parents Reletives Property Gift – YouTube – #36

Income Tax on Gift Rules in Hindi | Income Tax on Gift Received from Parents Reletives Property Gift – YouTube – #36

![How to gift money to parents in India: Tax, Limits [2020] - Wise How to gift money to parents in India: Tax, Limits [2020] - Wise](https://www.bankrate.com/2019/11/06220729/6-ways-to-give-money-as-a-gift.jpeg) How to gift money to parents in India: Tax, Limits [2020] – Wise – #37

How to gift money to parents in India: Tax, Limits [2020] – Wise – #37

Section 56(2)(X): Taxation of Gift – #38

Section 56(2)(X): Taxation of Gift – #38

Income Tax on Marriage Gift: Taxation of Wedding Gifts Received – Section 56 – Tax2win – #39

Income Tax on Marriage Gift: Taxation of Wedding Gifts Received – Section 56 – Tax2win – #39

- form 709 gift splitting example

Income Tax Implications of Wedding Gifts in India – #40

Income Tax Implications of Wedding Gifts in India – #40

Tax Strategies for Parents of Kids with Special Needs – The Autism Community in Action – #41

Tax Strategies for Parents of Kids with Special Needs – The Autism Community in Action – #41

School supplies are tax deductible | wfmynews2.com – #42

School supplies are tax deductible | wfmynews2.com – #42

How to Give Tax-Free Gifts to Children – #43

How to Give Tax-Free Gifts to Children – #43

How Much Money Can I Gift Without Owing Taxes? – #44

How Much Money Can I Gift Without Owing Taxes? – #44

Tax on Gifts in India | Exemption and Rules | EZTax® – #45

Tax on Gifts in India | Exemption and Rules | EZTax® – #45

5 Ways To Transfer Ownership of Property From Parents to Child – #46

5 Ways To Transfer Ownership of Property From Parents to Child – #46

Is Egg Donation IVF Tax-Deductible? – #47

Is Egg Donation IVF Tax-Deductible? – #47

Financial Gifts for Parents: Good financial gifts that you can give your parents – #48

Financial Gifts for Parents: Good financial gifts that you can give your parents – #48

Taxability of Gifts in India – #49

Taxability of Gifts in India – #49

Save Income Tax: Your parents, wife and children can help you save taxes. Here’s how – #50

Save Income Tax: Your parents, wife and children can help you save taxes. Here’s how – #50

Pros and Cons of the “Kiddie Tax” – CPA Practice Advisor – #51

Pros and Cons of the “Kiddie Tax” – CPA Practice Advisor – #51

) What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #52

What is the gift tax? | Gift tax limit 2023 – Jackson Hewitt – #52

Taxes On Gifts From Overseas – #53

Taxes On Gifts From Overseas – #53

- gift tax meaning

- gift tax exemption

- gift deed stamp paper

What is a gift deed and tax implications | Tax Hack – #54

What is a gift deed and tax implications | Tax Hack – #54

What are the legal implications of an employer giving their employees gifts with their own money, but not company funds? Would this be considered taxable income? If so, how much would be – #55

What are the legal implications of an employer giving their employees gifts with their own money, but not company funds? Would this be considered taxable income? If so, how much would be – #55

Your acts of generosity could unintentionally use your gift tax exemption – #56

Your acts of generosity could unintentionally use your gift tax exemption – #56

Tax on Gifts to Children: What You Need to Know – #57

Tax on Gifts to Children: What You Need to Know – #57

Gifting Money to Your Kids for College Tuition | SoFi – #58

Gifting Money to Your Kids for College Tuition | SoFi – #58

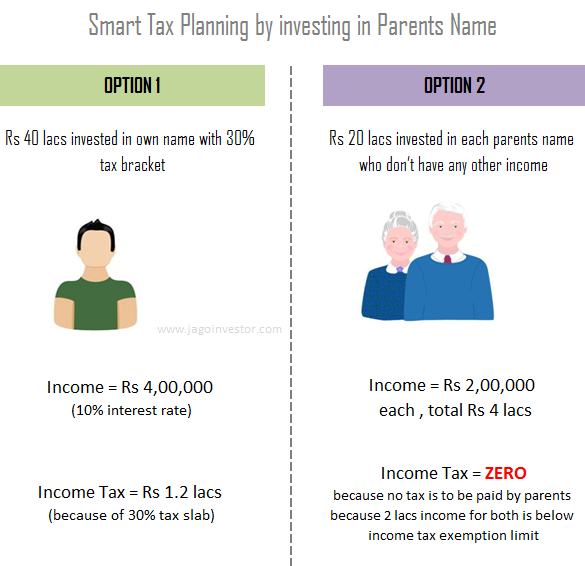

Three ways in which you can save tax through your parents | Mint – #59

Three ways in which you can save tax through your parents | Mint – #59

Taxability of Gift received by an individual or HUF with FAQs – #60

Taxability of Gift received by an individual or HUF with FAQs – #60

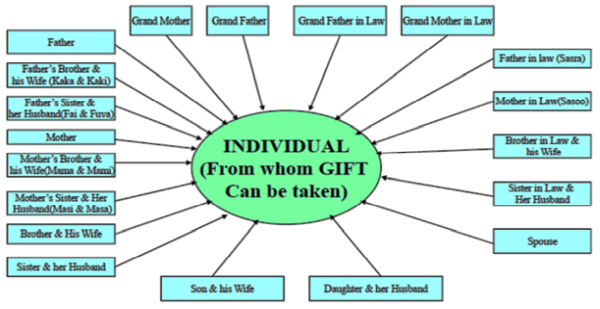

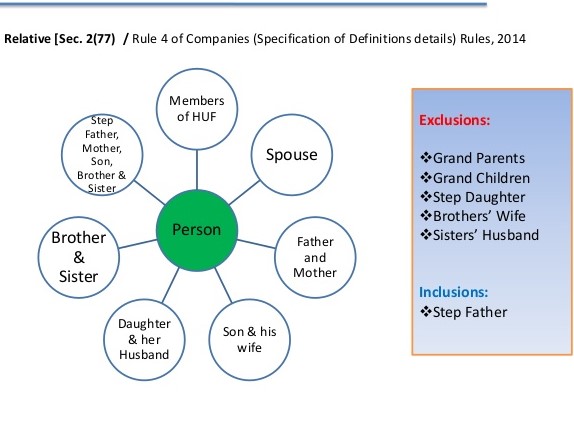

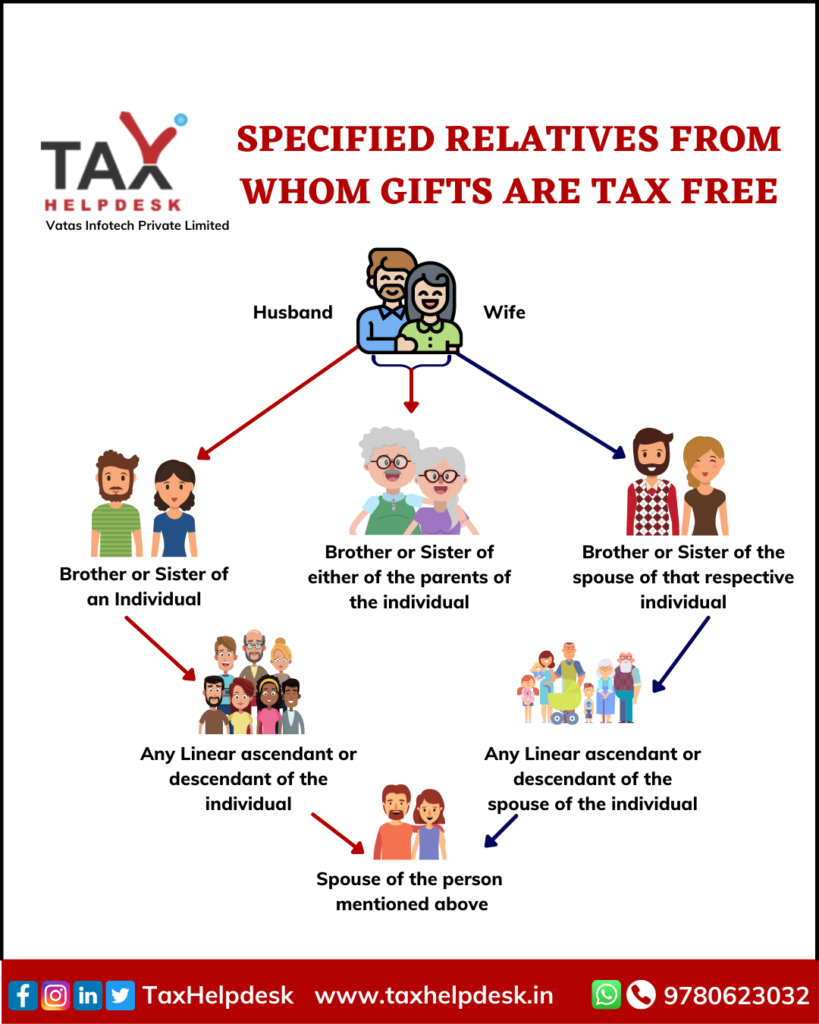

Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #61

Relatives u/s 56(2)(vii) from whom Gift is permissible…… – Income Tax | Tax planning – #61

Lifetime Gift Tax Exemption – FasterCapital – #62

Lifetime Gift Tax Exemption – FasterCapital – #62

All You Need To Know About Gifting Property And Gift Deed Rules – #63

All You Need To Know About Gifting Property And Gift Deed Rules – #63

- property gift deed

- form 709 example

- gift tax rate

How to claim parents or adult kids as dependents on your taxes. – The Washington Post – #64

How to claim parents or adult kids as dependents on your taxes. – The Washington Post – #64

Tax implications of gifting bank account, demat account and PPF to 18-year-old son – The Economic Times – #65

Tax implications of gifting bank account, demat account and PPF to 18-year-old son – The Economic Times – #65

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #66

What Is the Lifetime Gift Tax Exemption for 2024? | SmartAsset – #66

Counterintuitive tax planning: Increasing taxable scholarship income to reduce taxes – #67

Counterintuitive tax planning: Increasing taxable scholarship income to reduce taxes – #67

Solved The following information applies to Emily for 2022. | Chegg.com – #68

Solved The following information applies to Emily for 2022. | Chegg.com – #68

I Want to Give Money to My Daughter and Son-in-Law. How Much Can I Give Without Triggering Taxes? – #69

I Want to Give Money to My Daughter and Son-in-Law. How Much Can I Give Without Triggering Taxes? – #69

6 Ways To Give Money As A Gift | Bankrate – #70

6 Ways To Give Money As A Gift | Bankrate – #70

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #71

Things an NRI must know about gift tax rules in India | IDFC FIRST Bank – #71

Gift Tax In 2024: What Is It And How Does It Work? – #72

Gift Tax In 2024: What Is It And How Does It Work? – #72

How to calculate income tax on gifts from relatives? – #73

How to calculate income tax on gifts from relatives? – #73

Trim your tax bill by doing this: Gift money, pay rent to your parents | Personal Finance – Business Standard – #74

Trim your tax bill by doing this: Gift money, pay rent to your parents | Personal Finance – Business Standard – #74

Tax on Foreign Remittance in India: Sending & Receiving Money – #75

Tax on Foreign Remittance in India: Sending & Receiving Money – #75

- gift tax exemption relatives list

- gift tax returns irs completed sample form 709 sample

- gift tax act 1958

Rules for Overseas Money Transfer to Family Members Abroad | Unimoni.in – #76

Rules for Overseas Money Transfer to Family Members Abroad | Unimoni.in – #76

Using trusts to shift income to children – #77

Using trusts to shift income to children – #77

Gifts to Employees – Taxable Income or Nontaxable Gift – #78

Gifts to Employees – Taxable Income or Nontaxable Gift – #78

Major Things that Every Person Must Know About Tax on Gift in India | Tax & Investment Consultants – #79

Major Things that Every Person Must Know About Tax on Gift in India | Tax & Investment Consultants – #79

) Income Tax on Digital, Physical, and Paper Gold in India | IIFL Finance – #80

Income Tax on Digital, Physical, and Paper Gold in India | IIFL Finance – #80

Gift Tax: How Much Is It and Who Pays It? – #81

Gift Tax: How Much Is It and Who Pays It? – #81

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #82

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #82

Solved A 22-year-old full-time student earned $11,000 in | Chegg.com – #83

Solved A 22-year-old full-time student earned $11,000 in | Chegg.com – #83

These 13 Tax Breaks Can Save You Money — Even If You File Last Minute – CNET – #84

These 13 Tax Breaks Can Save You Money — Even If You File Last Minute – CNET – #84

Various Types of Tax in India | PDF | Taxes | Value Added Tax – #85

Various Types of Tax in India | PDF | Taxes | Value Added Tax – #85

Income clubbing: Are you trying to save tax by investing in the name of your parents or wife? | Arthgyaan – #86

Income clubbing: Are you trying to save tax by investing in the name of your parents or wife? | Arthgyaan – #86

11 Tax-Free Income Sources In India (2023 Update) – #87

11 Tax-Free Income Sources In India (2023 Update) – #87

Is Foster Income Taxable? What Foster Parents Should Know About Income Tax – – #88

Is Foster Income Taxable? What Foster Parents Should Know About Income Tax – – #88

Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It – #89

Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It – #89

Investing in Name of Parents – Key Benefits | TheWealthWisher (TW2) – #90

Investing in Name of Parents – Key Benefits | TheWealthWisher (TW2) – #90

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #91

Gift Tax Explained: What It Is and How Much You Can Gift Tax-Free – #91

How do i transfer money from usa to my parents bank account in India and what are the tax implications of it? – Quora – #92

How do i transfer money from usa to my parents bank account in India and what are the tax implications of it? – Quora – #92

Do You Need to File Gift Tax Returns? Avoid These Common Mistakes | Bennett Thrasher – #93

Do You Need to File Gift Tax Returns? Avoid These Common Mistakes | Bennett Thrasher – #93

Gifts & Income Tax Implications : Scenarios & Examples – #94

Gifts & Income Tax Implications : Scenarios & Examples – #94

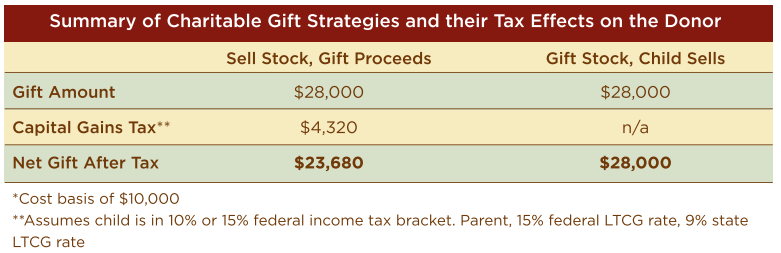

One simple (and unknown) trick that will increase your tax savings by more than 50% on your charitable contributions – A Place Of Possibility – #95

One simple (and unknown) trick that will increase your tax savings by more than 50% on your charitable contributions – A Place Of Possibility – #95

NRI Gift Tax Guide: Understanding Tax Implications in India – #96

NRI Gift Tax Guide: Understanding Tax Implications in India – #96

Income Tax Return Filing – Alritz Consultancy – These are the situations where money without consideration, i.e., monetary gift received by an individual or HUF is not charged to tax | Facebook – #97

Income Tax Return Filing – Alritz Consultancy – These are the situations where money without consideration, i.e., monetary gift received by an individual or HUF is not charged to tax | Facebook – #97

My father wants to gift cash to me. Should I pay income tax on money received from my father? | Mint – #98

My father wants to gift cash to me. Should I pay income tax on money received from my father? | Mint – #98

Understanding Section 56(2)(x) of the Income Tax Act: Taxation of Gifts Received Without Consideration or for Inadequate Consideration – Marg ERP Blog – #99

Understanding Section 56(2)(x) of the Income Tax Act: Taxation of Gifts Received Without Consideration or for Inadequate Consideration – Marg ERP Blog – #99

The Generation-Skipping Transfer Tax: A Quick Guide – #100

The Generation-Skipping Transfer Tax: A Quick Guide – #100

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #101

How are Gifts Taxed- Gift Exemption, Limits & Relatives List – #101

1040 (2023) | Internal Revenue Service – #102

1040 (2023) | Internal Revenue Service – #102

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #103

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #103

Narayana Murthy gifts Infosys shares worth Rs 240 cr to his 4-month-old grandson: How are gifts taxed in India? – #104

Narayana Murthy gifts Infosys shares worth Rs 240 cr to his 4-month-old grandson: How are gifts taxed in India? – #104

Can I Be Taxed For Gifting My Business? — Thienel Law – #105

Can I Be Taxed For Gifting My Business? — Thienel Law – #105

- gift tax in india

- gift deed format father to son

- section 56(2) of income tax act

- gift tax example

- gift deed format on stamp paper

- gift tax exemption 2022

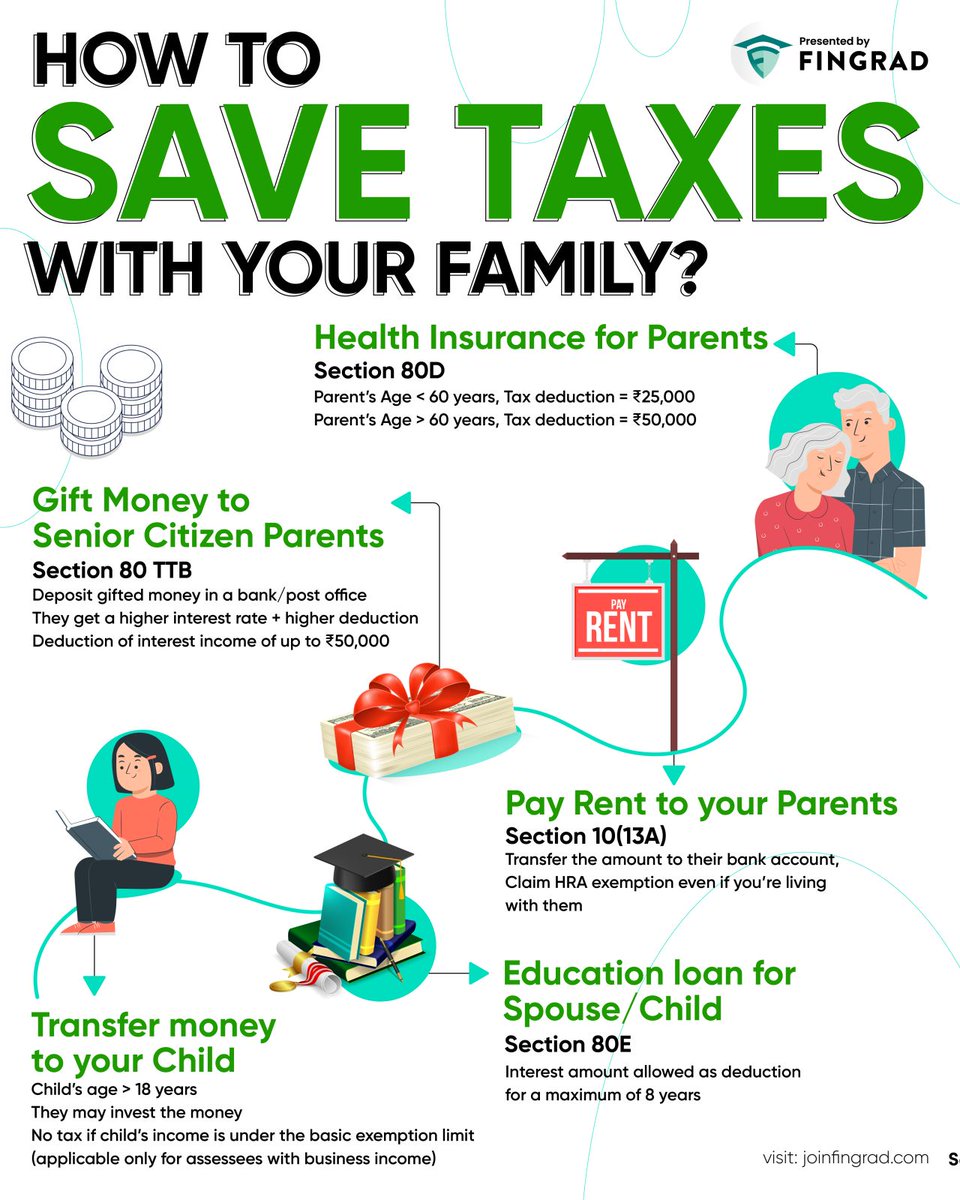

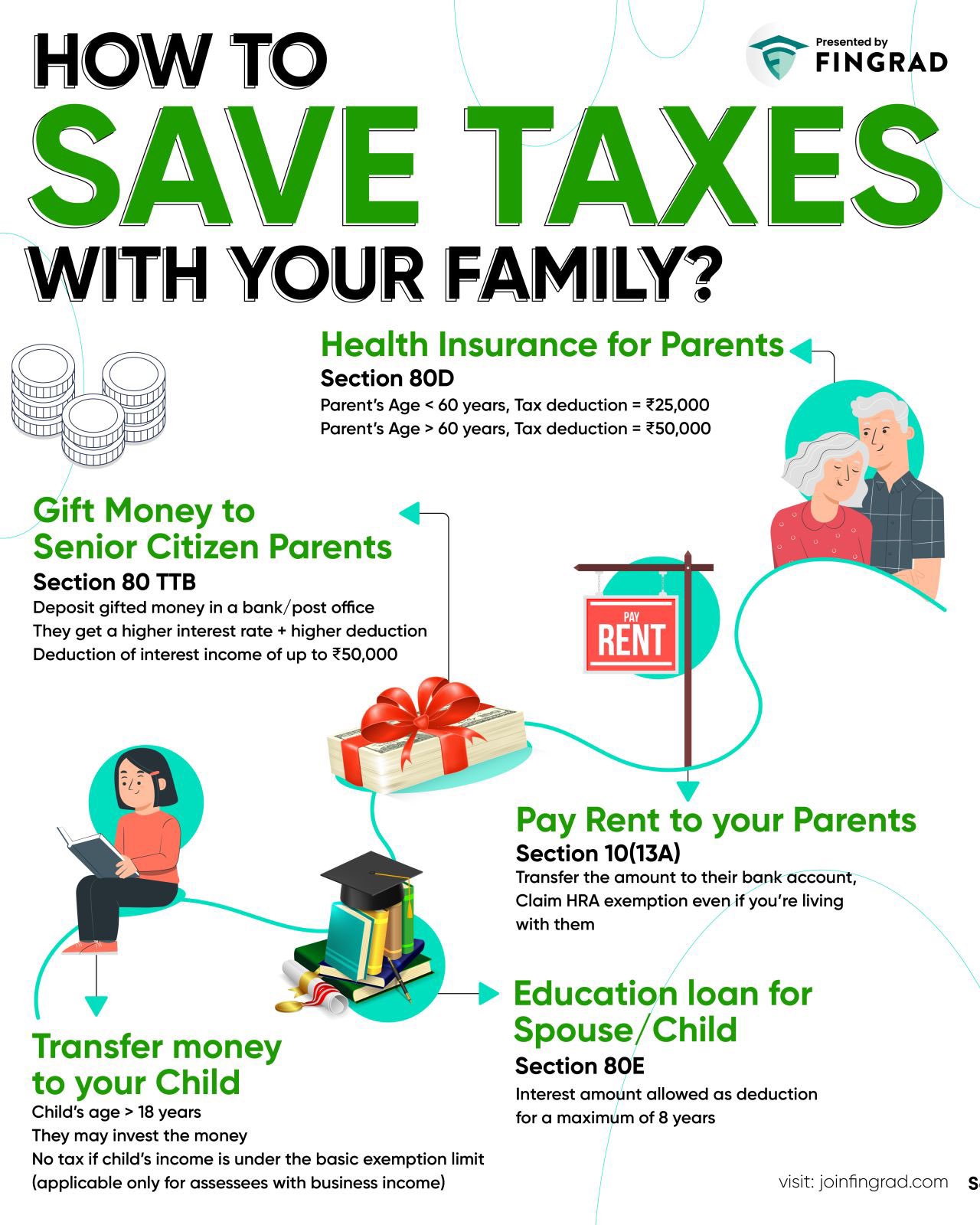

Kritesh Abhishek on X: “How to Save Taxes with your family? – Health Insurance for Parents – Gift Money to Senior Citizen Parents – Pay rent to parents – Transfer money to – #106

Kritesh Abhishek on X: “How to Save Taxes with your family? – Health Insurance for Parents – Gift Money to Senior Citizen Parents – Pay rent to parents – Transfer money to – #106

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #107

Income Tax on Diwali Gift: How Cash, Gold, Car and Property Gifts are Taxed – Income Tax News | The Financial Express – #107

Taxation of Minor Children in India: How Does It Work? – #108

Taxation of Minor Children in India: How Does It Work? – #108

Crypto Gift Tax | Your Guide | Koinly – #109

Crypto Gift Tax | Your Guide | Koinly – #109

Gift Tax vs. Inheritance Tax: How They Impact Beneficiaries | Thrivent – #110

Gift Tax vs. Inheritance Tax: How They Impact Beneficiaries | Thrivent – #110

25+ Best Things to Gift your Parents from your First Salary – #111

25+ Best Things to Gift your Parents from your First Salary – #111

What Is The Tax Liability On Gifts Received? – #112

What Is The Tax Liability On Gifts Received? – #112

What Are the Legal and Tax Implications of Using Gift Cards in India? – #113

What Are the Legal and Tax Implications of Using Gift Cards in India? – #113

- lineal ascendant gift from relative exempt from income tax

- 709 2020 gift tax sample completed irs form 709

- gift tax definition

What You Need to Know About Stock Gift Tax – #114

What You Need to Know About Stock Gift Tax – #114

Monetary gift tax: Income tax on gift received from parents | Value Research – #115

Monetary gift tax: Income tax on gift received from parents | Value Research – #115

Section 56(2)(x): Taxability of Gifts – Pioneer One Consulting LLP – #116

Section 56(2)(x): Taxability of Gifts – Pioneer One Consulting LLP – #116

Zero Tax on Salary Income INR 20+ Lakhs? Legal Way Here… – #117

Zero Tax on Salary Income INR 20+ Lakhs? Legal Way Here… – #117

Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #118

Gift Tax – Do I Have to Pay Taxes on a Gift | Gift Tax Calculator – #118

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #119

What Is the 2023 and 2024 Gift Tax Limit? – Ramsey – #119

All about Income Tax on Gift Received From Parents. – #120

All about Income Tax on Gift Received From Parents. – #120

How to ensure the cash gift from parents doesn’t land you in tax trouble – Money News | The Financial Express – #121

How to ensure the cash gift from parents doesn’t land you in tax trouble – Money News | The Financial Express – #121

Easy to Judge Income Tax Liability on Minors with Examples – #122

Easy to Judge Income Tax Liability on Minors with Examples – #122

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #123

Gift Tax Limit 2024: How Much Money Can You Gift? | SmartAsset – #123

Gift from USA to India: Taxation and Exemptions – SBNRI – #124

Gift from USA to India: Taxation and Exemptions – SBNRI – #124

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #125

7 Tax Rules to Know if You Give or Receive Cash | Taxes | U.S. News – #125

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #126

Diwali season: Do you have to pay tax on gifts received ? | Personal Finance – Business Standard – #126

Property Tax Re-Assessment – bubbleinfo.com – #127

Property Tax Re-Assessment – bubbleinfo.com – #127

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #128

How are Gifts Taxed? – Gift Tax Exemption Relatives List – #128

Will You Owe a Gift Tax This Year? – #129

Will You Owe a Gift Tax This Year? – #129

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab – #130

35 Best Gift Letter Templates (Word & PDF) ᐅ TemplateLab – #130

Gift Splitting and Gift Taxes – FasterCapital – #131

Gift Splitting and Gift Taxes – FasterCapital – #131

The best ways of gifting money to grandchildren – #132

The best ways of gifting money to grandchildren – #132

Stamp Duty, Registration fee on Gif Deed Among Blood Relatives – #133

Stamp Duty, Registration fee on Gif Deed Among Blood Relatives – #133

Is a gift from your cousin taxable? – #134

Is a gift from your cousin taxable? – #134

3.11.3 Individual Income Tax Returns | Internal Revenue Service – #135

3.11.3 Individual Income Tax Returns | Internal Revenue Service – #135

Exploring the estate tax: Part 2 – Journal of Accountancy – #136

Exploring the estate tax: Part 2 – Journal of Accountancy – #136

Real State – Honoring Human Dignity – #137

Real State – Honoring Human Dignity – #137

Tax on the gift from father to daughter – #138

Tax on the gift from father to daughter – #138

Taxability of Gifts – Some Interesting Issues – #139

Taxability of Gifts – Some Interesting Issues – #139

Generation-Skipping Transfer Taxes – #140

Generation-Skipping Transfer Taxes – #140

FAQs on NRI Gift Deeds: Property Gifting by Non-Resident Indians in India – #141

FAQs on NRI Gift Deeds: Property Gifting by Non-Resident Indians in India – #141

Giving Or Receiving A Down Payment Gift? Here’s What You Need To Know – #142

Giving Or Receiving A Down Payment Gift? Here’s What You Need To Know – #142

🪔✨ Gifting Joy: Know the tax implications of sharing Diwali gifts. | Prateek Mitruka posted on the topic | LinkedIn – #143

🪔✨ Gifting Joy: Know the tax implications of sharing Diwali gifts. | Prateek Mitruka posted on the topic | LinkedIn – #143

Tax considerations when gifting stock – InvestmentNews – #144

Tax considerations when gifting stock – InvestmentNews – #144

What is a Gift Tax and What are its Rates and Exemptions? | Fi Money – #145

What is a Gift Tax and What are its Rates and Exemptions? | Fi Money – #145

Tuition Gift Tax Exclusion – #146

Tuition Gift Tax Exclusion – #146

All you need to know about taxes on gifts and the exceptions | Mint – #147

All you need to know about taxes on gifts and the exceptions | Mint – #147

tax treatment of gifts | PDF – #148

tax treatment of gifts | PDF – #148

Best ways to save taxes (other than Section 80C) – #149

Best ways to save taxes (other than Section 80C) – #149

Understanding Section 56 of the Income Tax Act – Marg ERP Blog – #150

Understanding Section 56 of the Income Tax Act – Marg ERP Blog – #150

Kiddie Tax – FasterCapital – #151

Kiddie Tax – FasterCapital – #151

- federal gift tax

- gift chart as per income tax

- gift from relative exempt from income tax

Taxability of Gifts – #152

Taxability of Gifts – #152

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding / Front-Loading — My Money Blog – #153

Completed Sample IRS Form 709 Gift Tax Return for 529 Superfunding / Front-Loading — My Money Blog – #153

Holiday gift tax planning for IRAs – #154

Holiday gift tax planning for IRAs – #154

Section 56(2)(X) of Income Tax Act – Tax Implication on Gifts – #155

Section 56(2)(X) of Income Tax Act – Tax Implication on Gifts – #155

Tax on gifts and inheritances | ATO Community – #156

Tax on gifts and inheritances | ATO Community – #156

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #157

ITR filing: Are gifts taxable in India? Salient clauses all income taxpayers must know | Zee Business – #157

Income Tax on Gift – #158

Income Tax on Gift – #158

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #159

Income tax on gifts: Know when your gift is tax-free – BusinessToday – #159

Annual Gift Tax Exclusions | First Republic now part of JPMorgan Chase – #160

Annual Gift Tax Exclusions | First Republic now part of JPMorgan Chase – #160

Tax implications on gifts and how your family can help you save tax – #161

Tax implications on gifts and how your family can help you save tax – #161

BMC – Business Management Company, Inc. | Frederick MD – #162

BMC – Business Management Company, Inc. | Frederick MD – #162

Gift taxation | ITR: Gifts have to be declared in ITR: Here’s how they are taxed – #163

Gift taxation | ITR: Gifts have to be declared in ITR: Here’s how they are taxed – #163

Taxability of Gift U/s 56(2)(X) – #164

Taxability of Gift U/s 56(2)(X) – #164

How can your parents help you save tax & earn more? – Income Tax News | The Financial Express – #165

How can your parents help you save tax & earn more? – Income Tax News | The Financial Express – #165

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #166

Your Diwali gift and bonus can be taxable: Know ways to avoid it – #166

Gift Letter ≡ Fill Out Printable PDF Forms Online – #167

Gift Letter ≡ Fill Out Printable PDF Forms Online – #167

Giving Your Home to Your Children Can Have Tax Consequences – #168

Giving Your Home to Your Children Can Have Tax Consequences – #168

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #169

Income tax filing: Are gifts taxable? Frequently asked questions on gift taxes | Zee Business – #169

Taxation of Gifts received in Cash or Kind – #170

Taxation of Gifts received in Cash or Kind – #170

Are Cash Gifts from relatives exempt from Income tax? – #171

Are Cash Gifts from relatives exempt from Income tax? – #171

Income Tax Saving: Wedding gift and investment in the name of parents, know the ways to save income tax.. – #172

Income Tax Saving: Wedding gift and investment in the name of parents, know the ways to save income tax.. – #172

Solved Taylor, age 18 , is claimed as a dependent by her | Chegg.com – #173

Solved Taylor, age 18 , is claimed as a dependent by her | Chegg.com – #173

Tax Breaks for Generous Grandparents | NEA Member Benefits – #174

Tax Breaks for Generous Grandparents | NEA Member Benefits – #174

Gifts vs. Loans: Don’t Be Generous to a Fault | Kiplinger – #175

Gifts vs. Loans: Don’t Be Generous to a Fault | Kiplinger – #175

Here’s what you need to know about different forms of gold you can buy and their tax treatment – BusinessToday – #176

Here’s what you need to know about different forms of gold you can buy and their tax treatment – BusinessToday – #176

Do You Pay Taxes on Gifts From Parents? (2023 and 2024) | SmartAsset – #177

Do You Pay Taxes on Gifts From Parents? (2023 and 2024) | SmartAsset – #177

Making Gifts to Minors – #178

Making Gifts to Minors – #178

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #179

What You Need to Know Before Gifting Money to Family | Savant Wealth Management – #179

Gift Tax 2024: How much can a parent give their child in a year? | verifythis.com – #180

Gift Tax 2024: How much can a parent give their child in a year? | verifythis.com – #180

HSA Tax Benefits For Parents With Adult Children Under 26 – #181

HSA Tax Benefits For Parents With Adult Children Under 26 – #181

Gift Tax 2023 | What It Is, Annual Limit, Lifetime Exemption, & Gift Tax Rate – #182

Gift Tax 2023 | What It Is, Annual Limit, Lifetime Exemption, & Gift Tax Rate – #182

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #183

When is money gifted not taxable? All your tax queries on gifts answered | Personal Finance – Business Standard – #183

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #184

Did you receive Gift? Tax Implications on Gifts | Examples, Limits & Rules – #184

Form 709: What It Is and Who Must File It – #185

Form 709: What It Is and Who Must File It – #185

What You Need to Know Before Gifting a 529 Plan – #186

What You Need to Know Before Gifting a 529 Plan – #186

A Guide to Gifting Money to Your Children | City National Bank – #187

A Guide to Gifting Money to Your Children | City National Bank – #187

Gift of Immovable property under Income Tax Act – #188

Gift of Immovable property under Income Tax Act – #188

) 6 tax tips for college students – MSU Denver RED – #189

6 tax tips for college students – MSU Denver RED – #189

Tax on Wedding Gifts – Explained | EZTax® – #190

Tax on Wedding Gifts – Explained | EZTax® – #190

Do I have to pay taxes if I receive money from my parents to pay rent? All money I get from them I put in bank then write check – Quora – #191

Do I have to pay taxes if I receive money from my parents to pay rent? All money I get from them I put in bank then write check – Quora – #191

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #192

Detailed Analysis- Gifts Taxation under Income Tax Act, 1961 – #192

gift taxation: Which gifts are taxable for the recipient and which ones can increase tax liability of giver – The Economic Times – #193

gift taxation: Which gifts are taxable for the recipient and which ones can increase tax liability of giver – The Economic Times – #193

Section 56(2)(vii) : Cash / Non-Cash Gifts – #194

Section 56(2)(vii) : Cash / Non-Cash Gifts – #194

income tax: How your parents, spouse and children can help you save tax – The Economic Times – #195

income tax: How your parents, spouse and children can help you save tax – The Economic Times – #195

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #196

Understanding Income Tax on Gifts Received in India: Rules, Exceptions, and Valuation” – #196

income tax on gifts received from parents Archives – CA GuruJi – #197

income tax on gifts received from parents Archives – CA GuruJi – #197

Legacy IRA Rollover To Charitable Gift Annuity – #198

Legacy IRA Rollover To Charitable Gift Annuity – #198

Foreign Gift Tax – Ultimate Insider Info You Need To Know – #199

Foreign Gift Tax – Ultimate Insider Info You Need To Know – #199

What are some unusual ways of saving income tax in India? – Quora – #200

What are some unusual ways of saving income tax in India? – Quora – #200

Posts: gift to parents income tax

Categories: Gifts

Author: toyotabienhoa.edu.vn