Discover 131+ taxability of gift

Update images of taxability of gift by website toyotabienhoa.edu.vn compilation. Gifting Company Stock: A Step-by-Step Guide | Eqvista. Notice of Tax Reportable Gift Card, E-Gift Card, Gift Certificate. Giving gifts and throwing parties can help show gratitude and provide tax breaks – Mize CPAs Inc.. You can save tax by gifting cash, jewellery, property to family members

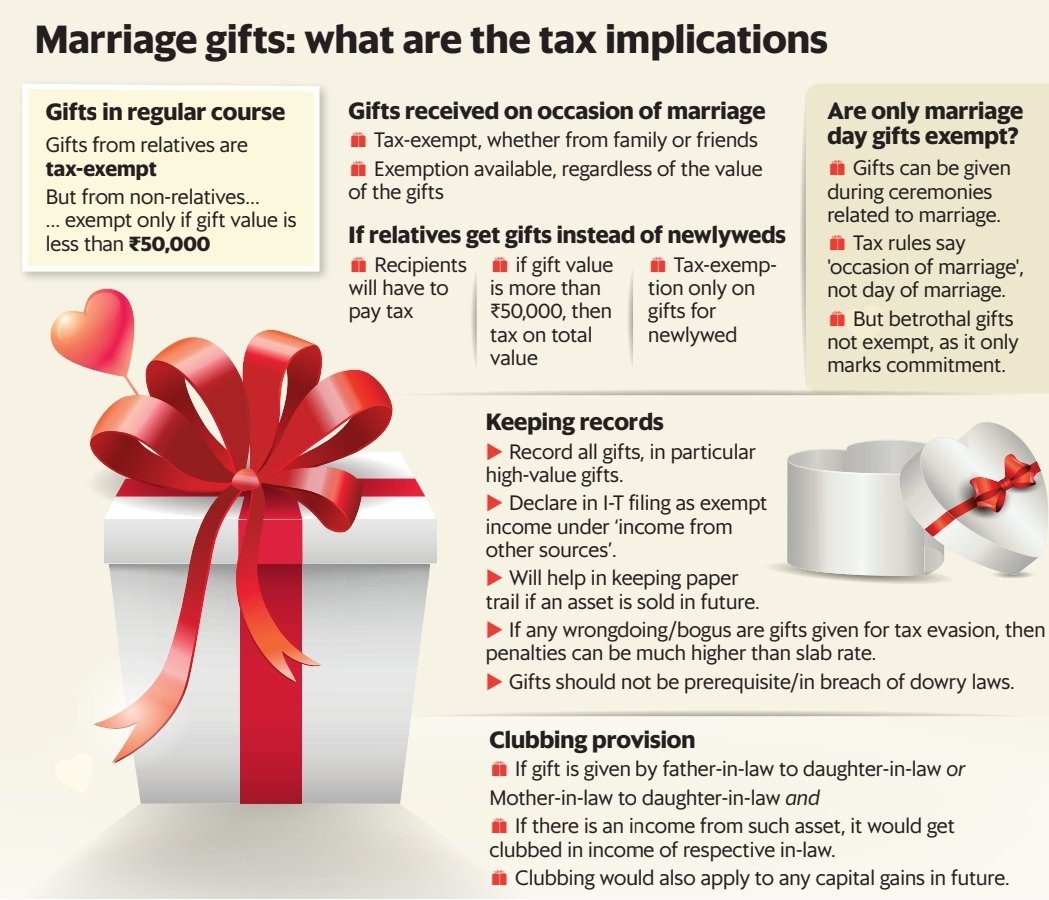

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #1

Stridhan: Income Tax Laws For Wedding Gifts That Every Indian Woman Must Know | HerZindagi – #1

) Solved Elizabeth made taxable gifts of $6,550,000 in 2020 | Chegg.com – #2

Solved Elizabeth made taxable gifts of $6,550,000 in 2020 | Chegg.com – #2

Gifts from Foreign Corporations Included as Gross Income – #3

Gifts from Foreign Corporations Included as Gross Income – #3

1st Edition 2022: Buy The Gift Tax Act 1958 – #4

1st Edition 2022: Buy The Gift Tax Act 1958 – #4

Tax and Legal Issues Arising In Connection With the Preparation of the Federal Gift Tax Return, Form 709 — Treatise | Law Offices of David L. Silverman – #5

Tax and Legal Issues Arising In Connection With the Preparation of the Federal Gift Tax Return, Form 709 — Treatise | Law Offices of David L. Silverman – #5

Chairman’s News | Newsroom | The United States Senate Committee on Finance – #6

Chairman’s News | Newsroom | The United States Senate Committee on Finance – #6

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #7

Gift Tax: How It Works, Rates in 2023-2024 – NerdWallet – #7

![When Parents Accidentally Gift Real Estate to Children [Tax Smart Daily 052] When Parents Accidentally Gift Real Estate to Children [Tax Smart Daily 052]](https://eqvista.com/app/uploads/2022/08/Factors-to-consider-before-determining-gift-and-estate-tax-valuation.png) When Parents Accidentally Gift Real Estate to Children [Tax Smart Daily 052] – #8

When Parents Accidentally Gift Real Estate to Children [Tax Smart Daily 052] – #8

3.11.106 Estate and Gift Tax Returns | Internal Revenue Service – #9

3.11.106 Estate and Gift Tax Returns | Internal Revenue Service – #9

Is there a limit in income tax laws up to which a father can gift to his son – #10

Is there a limit in income tax laws up to which a father can gift to his son – #10

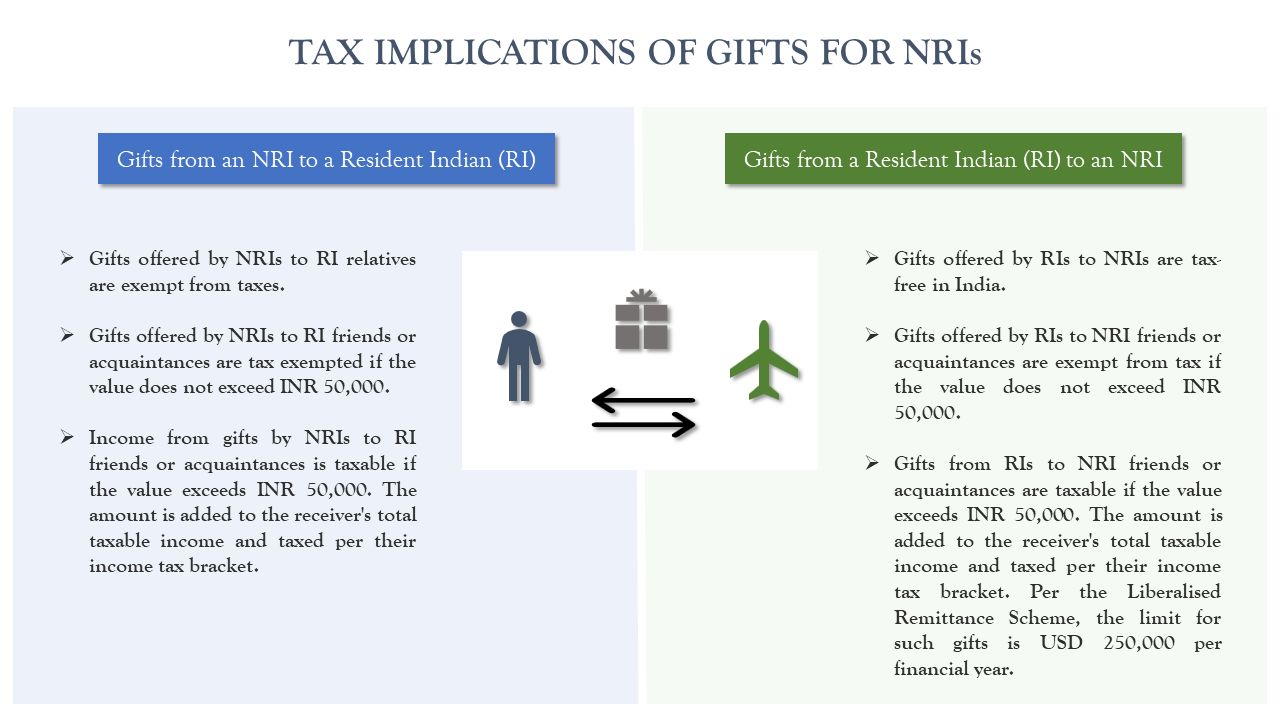

Gifts by NRIs to Relatives and Friends can be made fully Exempt from Gift Tax – #11

Gifts by NRIs to Relatives and Friends can be made fully Exempt from Gift Tax – #11

Gift Tax: Are Gifts to Children or Relatives Abroad Taxable? – Income Tax News, Judgments, Act, Analysis, Tax Planning, Advisory, E filing of returns, CA Students – #12

Gift Tax: Are Gifts to Children or Relatives Abroad Taxable? – Income Tax News, Judgments, Act, Analysis, Tax Planning, Advisory, E filing of returns, CA Students – #12

Gifting Company Stock: A Step-by-Step Guide | Eqvista – #13

Gifting Company Stock: A Step-by-Step Guide | Eqvista – #13

Property Received As Gift From A Relative Is Exempt From Tax – #14

Property Received As Gift From A Relative Is Exempt From Tax – #14

What is the gift tax and how does it affect you? – #15

What is the gift tax and how does it affect you? – #15

- gift tax definition economics

- estate/gift tax

Tax on Gift : गिफ्ट्सवर कसा लागतो कर, जाणून घ्या-how is the tax on gifts definitely know all the multiplication and maths ,बिझनेस बातम्या – #16

Tax on Gift : गिफ्ट्सवर कसा लागतो कर, जाणून घ्या-how is the tax on gifts definitely know all the multiplication and maths ,बिझनेस बातम्या – #16

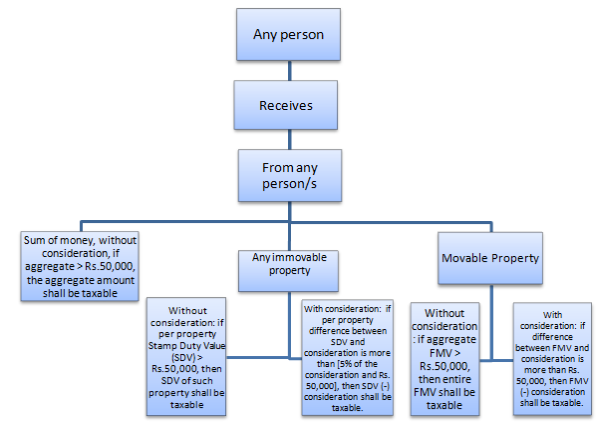

Gift Tax | Gift Tax In India | Gift Tax under Income Tax | Tax on – #17

Gift Tax | Gift Tax In India | Gift Tax under Income Tax | Tax on – #17

Income Tax Impact on Gift to HUF & Gift by HUF – #18

Income Tax Impact on Gift to HUF & Gift by HUF – #18

Gift tax exemption | Tax on gift money | Value Research – #19

Gift tax exemption | Tax on gift money | Value Research – #19

) How Budget 2023 has increased the attractiveness for IFSC, GIFT IFSC – #20

How Budget 2023 has increased the attractiveness for IFSC, GIFT IFSC – #20

New Higher Estate And Gift Tax Limits For 2022: Couples Can Pass On $720,000 More Tax Free – #21

New Higher Estate And Gift Tax Limits For 2022: Couples Can Pass On $720,000 More Tax Free – #21

GIFT TAX Rules: Find out who needs to pay tax on gifts received – Banking School – #22

GIFT TAX Rules: Find out who needs to pay tax on gifts received – Banking School – #22

Tax Planning with the Annual Gift Tax Exclusion – Alloy Silverstein – #23

Tax Planning with the Annual Gift Tax Exclusion – Alloy Silverstein – #23

IRS Announces 2023 Estate & Gift Tax Exemption Amounts – Texas Agriculture Law – #24

IRS Announces 2023 Estate & Gift Tax Exemption Amounts – Texas Agriculture Law – #24

Gift Tax & The Holiday Season – Limits, Exceptions, & More – Aldridge Borden and Company – #25

Gift Tax & The Holiday Season – Limits, Exceptions, & More – Aldridge Borden and Company – #25

IRS Gift Limit 2024, Spousе & Minors, Tax Free Gift, Tax Rates – NCBlpc – #26

IRS Gift Limit 2024, Spousе & Minors, Tax Free Gift, Tax Rates – NCBlpc – #26

) Gift Tax 101: What You Need to Know — Connecticut Estate Planning Attorneys Blog – #27

Gift Tax 101: What You Need to Know — Connecticut Estate Planning Attorneys Blog – #27

U.S. MASTER ESTATE AND GIFT TAX GUIDE (2024): CCH Tax Law Editors: 9780808059196: Amazon.com: Books – #28

U.S. MASTER ESTATE AND GIFT TAX GUIDE (2024): CCH Tax Law Editors: 9780808059196: Amazon.com: Books – #28

Gifts Impact On Estate Tax Calculations – EstateTaxes.net – #29

Gifts Impact On Estate Tax Calculations – EstateTaxes.net – #29

- gift tax meaning

- estate tax exemption history

- federal estate tax

Gift and Estate Tax Exemption Limits Increase for 2024 – Texas Trust Law – #30

Gift and Estate Tax Exemption Limits Increase for 2024 – Texas Trust Law – #30

5 Things to Know About the Gift Tax | Virginia529 – #31

5 Things to Know About the Gift Tax | Virginia529 – #31

- gift tax exemption

- expenditure tax act

- wealth tax

Take care of gifts in festive season tax has to be paid on these things received in gifts – त्योहारी सीजन में संभल कर लें गिफ्ट, उपहार में मिले इन चीजों पर – #32

Take care of gifts in festive season tax has to be paid on these things received in gifts – त्योहारी सीजन में संभल कर लें गिफ्ट, उपहार में मिले इन चीजों पर – #32

Income tax rules on gifts as tax on gifts in india over a certain limit with exceptions | किसी से गिफ्ट ले रहे तो आपको देना होगा टैक्स, जान लीजिए क्या है – #33

Income tax rules on gifts as tax on gifts in india over a certain limit with exceptions | किसी से गिफ्ट ले रहे तो आपको देना होगा टैक्स, जान लीजिए क्या है – #33

Gift Tax Calculator: Meaning, Exclusion and Rates in 2023 – #34

Gift Tax Calculator: Meaning, Exclusion and Rates in 2023 – #34

Navigating the Estate Tax Horizon – Mercer Capital – #35

Navigating the Estate Tax Horizon – Mercer Capital – #35

Mary Smith on X: “#WeeklyPresidentialSpotlight: Join @ABAEsq for @rptelaw’s informative panel on the 709 Gift Tax, Feb. 6, 1 pm ET. Get practical insights on federal gift tax return, adequate disclosure rules, – #36

Mary Smith on X: “#WeeklyPresidentialSpotlight: Join @ABAEsq for @rptelaw’s informative panel on the 709 Gift Tax, Feb. 6, 1 pm ET. Get practical insights on federal gift tax return, adequate disclosure rules, – #36

What is French Gift Tax (“Droits de Donation”)? – The Good Life France – #37

What is French Gift Tax (“Droits de Donation”)? – The Good Life France – #37

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #38

Gift Tax in India: Implications & Exemptions – myMoneySage Blog – #38

Estate and Gift Tax Changes in the Taxpayer relief Act of 1997 – #39

Estate and Gift Tax Changes in the Taxpayer relief Act of 1997 – #39

- gift tax

- gift tax in india

- interest tax

Navigating Indian Tax Rules for NRI Gift Money: Key Considerations and Compliance Guidelines – #40

Navigating Indian Tax Rules for NRI Gift Money: Key Considerations and Compliance Guidelines – #40

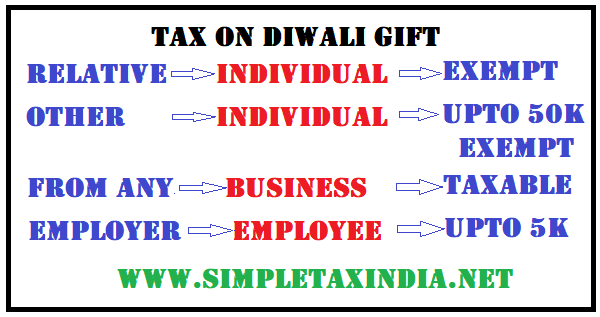

GIFT TAX -TAX ON GIFT BUDGET 2010 | SIMPLE TAX INDIA – #41

GIFT TAX -TAX ON GIFT BUDGET 2010 | SIMPLE TAX INDIA – #41

How to gift assets to family members while cutting tax rates | Financial Planning – #42

How to gift assets to family members while cutting tax rates | Financial Planning – #42

- gift from relative exempt from income tax

- gift tax example

- gift tax 2023

Gift of Immovable property under Income Tax Act – #43

Gift of Immovable property under Income Tax Act – #43

Gift Tax: Why Giving Away $15,000 Is a Trap For the Unwary – #44

Gift Tax: Why Giving Away $15,000 Is a Trap For the Unwary – #44

Federal Estate and Gift Tax Exemption set to Rise Substantially for 2023 – Murray Plumb & Murray – #45

Federal Estate and Gift Tax Exemption set to Rise Substantially for 2023 – Murray Plumb & Murray – #45

Make Gifts That Your Family Will Love but the IRS Won’t Tax – #46

Make Gifts That Your Family Will Love but the IRS Won’t Tax – #46

Do you need to pay taxes on your gifts? #tax #taxes #taxtok #gifttax #… | TikTok – #47

Do you need to pay taxes on your gifts? #tax #taxes #taxtok #gifttax #… | TikTok – #47

What is Gift Tax? – #48

What is Gift Tax? – #48

Gift Tax – Kirk & Simas – #49

Gift Tax – Kirk & Simas – #49

Gifts Your Family Will Love but the IRS Won’t Tax – Davis Law Group – #50

Gifts Your Family Will Love but the IRS Won’t Tax – Davis Law Group – #50

Whether gift received from HUF to any member of HUF is exempt from taxable income? ITAT Explains | SCC Times – #51

Whether gift received from HUF to any member of HUF is exempt from taxable income? ITAT Explains | SCC Times – #51

Understanding California Federal Estate And Gift Tax Rates – #52

Understanding California Federal Estate And Gift Tax Rates – #52

Gift deed : laws applicable, registration, stamp duty in various states and tax exemptions – iPleaders – #53

Gift deed : laws applicable, registration, stamp duty in various states and tax exemptions – iPleaders – #53

How Much Is the Gift Tax: Who Pays It and What Counts as a Gift – #54

How Much Is the Gift Tax: Who Pays It and What Counts as a Gift – #54

Will the estate tax exemption boogeyman get you this time? – #55

Will the estate tax exemption boogeyman get you this time? – #55

Adler & Adler | Lifetime Gifts to Reduce NY Estate Tax – #56

Adler & Adler | Lifetime Gifts to Reduce NY Estate Tax – #56

Gift received from mother shall not be termed as Unexplained Cash Credits: ITAT deletes addition imposed u/s 68 of Income Tax Act – #57

Gift received from mother shall not be termed as Unexplained Cash Credits: ITAT deletes addition imposed u/s 68 of Income Tax Act – #57

- gift tax return

- federal gift tax

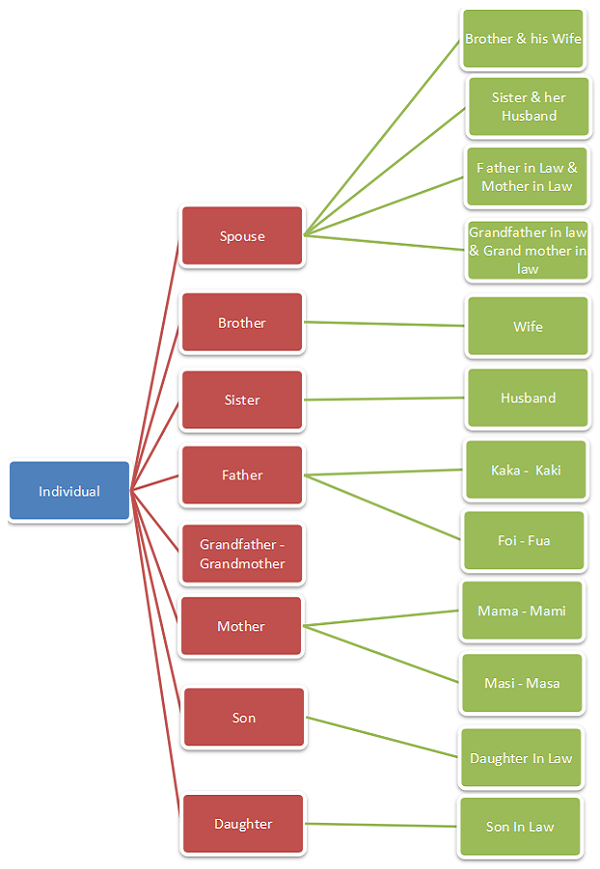

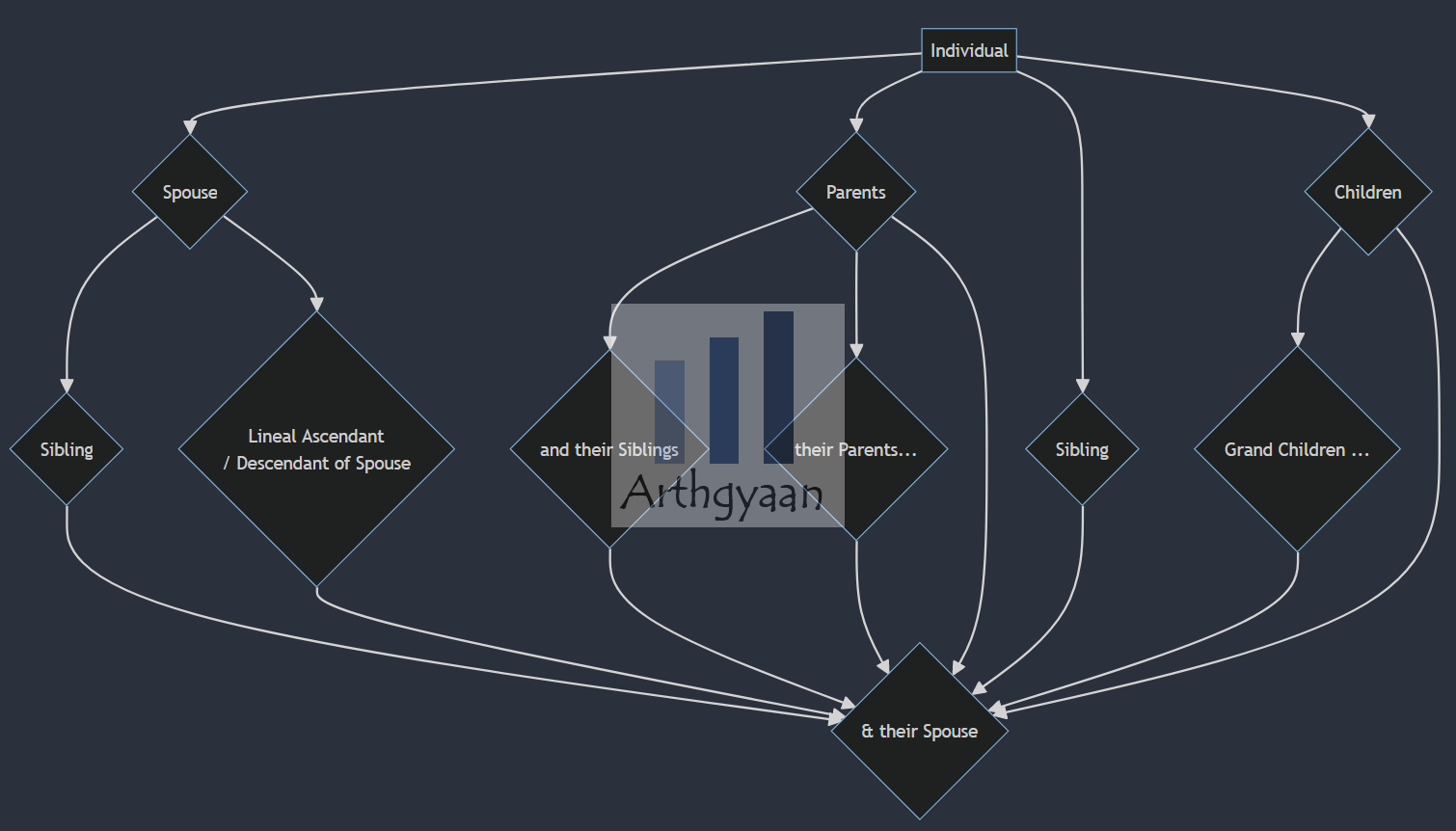

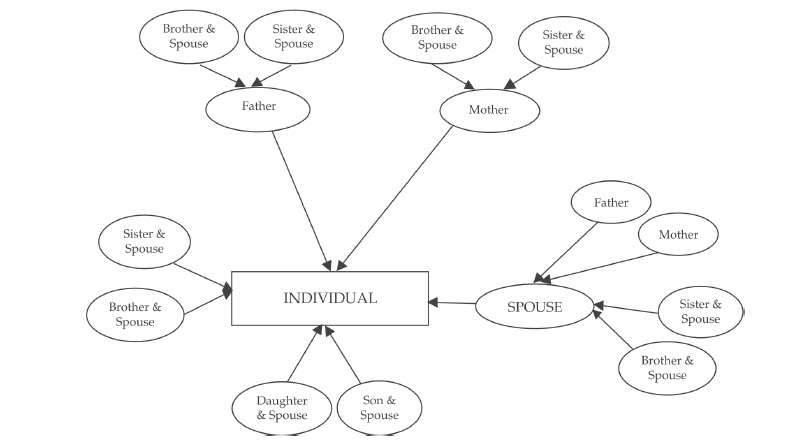

- gift tax exemption relatives list

- lineal ascendant gift from relative exempt from income tax

- gift tax rate in india 2022-23

- gift tax exemption 2022

ITAT Allows Depreciation Even When Asset Is Received As A Gift. – #58

ITAT Allows Depreciation Even When Asset Is Received As A Gift. – #58

Gift cards and sales tax: How not to get duped – CSMonitor.com – #59

Gift cards and sales tax: How not to get duped – CSMonitor.com – #59

-thumbnailImg-7442ea6c-8ccf-41c8-9626-008ebee2a92d.png) How Does the Gift Tax Work? – Opsahl Dawson – #60

How Does the Gift Tax Work? – Opsahl Dawson – #60

Gift Tax, the Annual Exclusion and Estate Planning – #61

Gift Tax, the Annual Exclusion and Estate Planning – #61

Gift Tax in 2020: How Much Can I Give Tax-Free? | The Motley Fool – #62

Gift Tax in 2020: How Much Can I Give Tax-Free? | The Motley Fool – #62

Plan now for year-end gifts with the gift tax annual exclusion – Miller Kaplan – #63

Plan now for year-end gifts with the gift tax annual exclusion – Miller Kaplan – #63

Greece Increases Gift Tax-exempt Bracket From October 1, 2021 – Inheritance Tax – Greece – #64

Greece Increases Gift Tax-exempt Bracket From October 1, 2021 – Inheritance Tax – Greece – #64

Gift from certain relatives is tax free in India | Mint – #65

Gift from certain relatives is tax free in India | Mint – #65

Diwali Gifts Tax: कंपनी, दोस्तों या रिश्तेदारों से मिल गया दिवाली गिफ्ट? जानिए अब कितना देना होगा टैक्स – Diwali Gifts Tax: Know how much tax you may have to pay on – #66

Diwali Gifts Tax: कंपनी, दोस्तों या रिश्तेदारों से मिल गया दिवाली गिफ्ट? जानिए अब कितना देना होगा टैक्स – Diwali Gifts Tax: Know how much tax you may have to pay on – #66

Tax matters: Uncle’s gift is tax free | Tax matters: Uncle’s gift is tax free – #67

Tax matters: Uncle’s gift is tax free | Tax matters: Uncle’s gift is tax free – #67

- estate tax

- gift tax rate table

- estate tax exemption

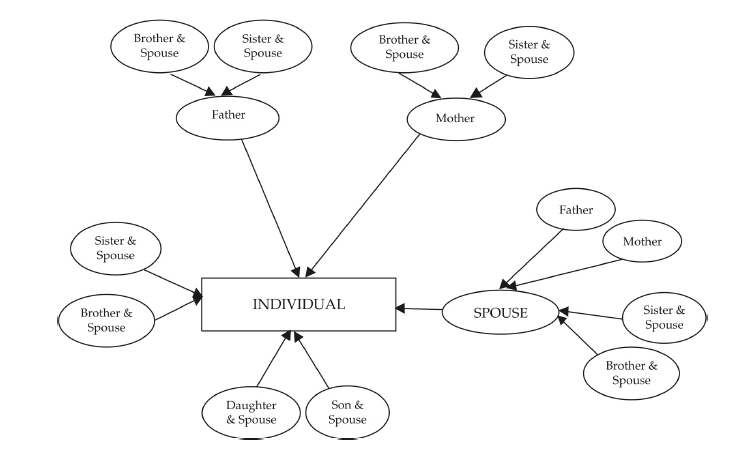

Rules For Taxation Of Gift In India – Labour Law Advisor – #68

Rules For Taxation Of Gift In India – Labour Law Advisor – #68

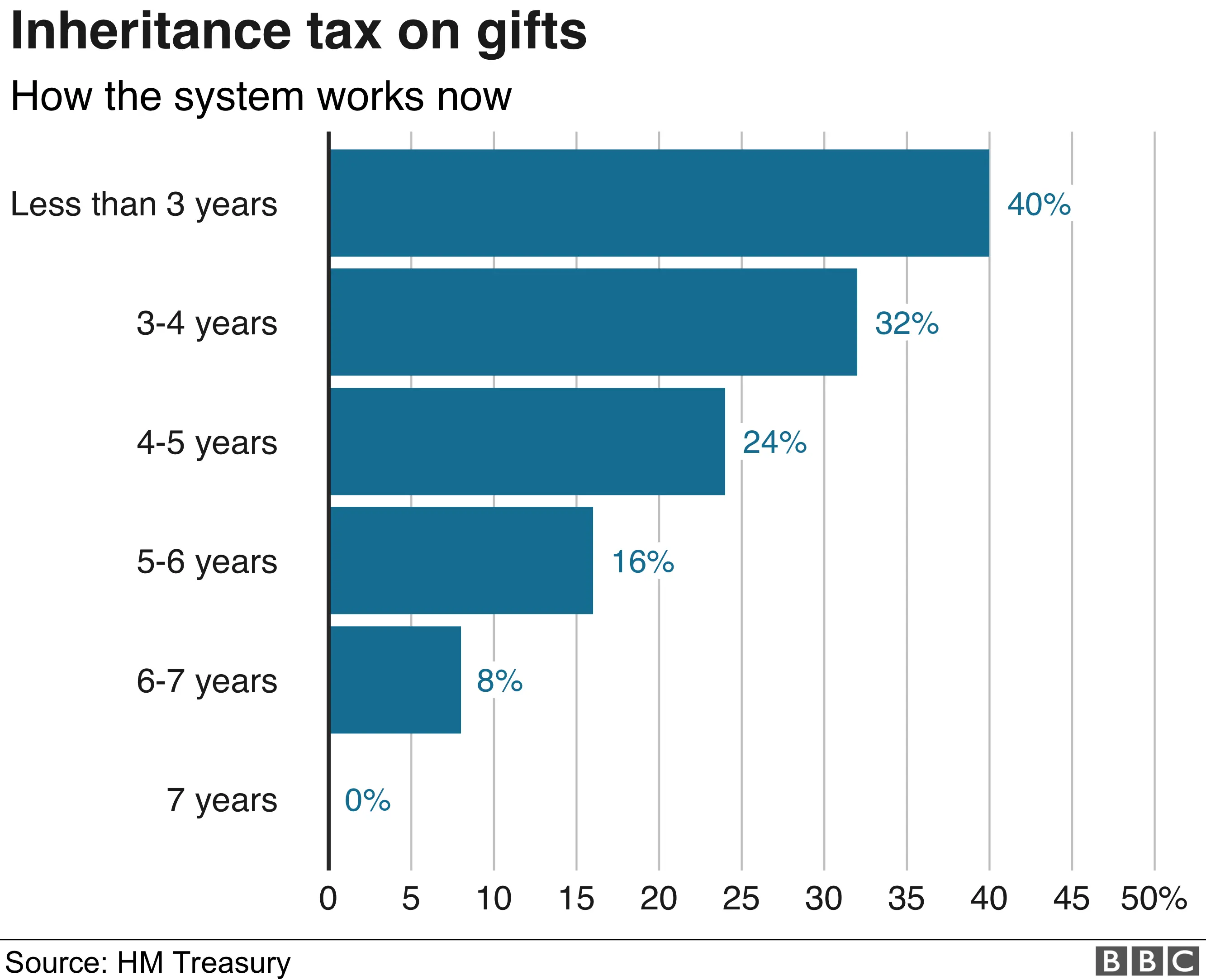

Inheritance tax: Rules on gifts to loved ones ‘should be simplified’ – #69

Inheritance tax: Rules on gifts to loved ones ‘should be simplified’ – #69

No Need to Fear a Federal Claw Back | Twomey Latham – #70

No Need to Fear a Federal Claw Back | Twomey Latham – #70

Are Diwali gifts from employer, relatives, friends taxable? Here’s a look at the norms | Mint – #71

Are Diwali gifts from employer, relatives, friends taxable? Here’s a look at the norms | Mint – #71

Estate & Gift Tax Strategies – Milton Law Group – #72

Estate & Gift Tax Strategies – Milton Law Group – #72

Tax Implications of Giving Gifts to Employees l Small Business Guide for Employee Gift l SwagMagic – #73

Tax Implications of Giving Gifts to Employees l Small Business Guide for Employee Gift l SwagMagic – #73

Taxability of Gifts in India – #74

Taxability of Gifts in India – #74

Gift Tax In 2024: What Is It And How Does It Work? – #75

Gift Tax In 2024: What Is It And How Does It Work? – #75

Gift Tax rules for US citizens (Guidelines) | Expat US Tax – #76

Gift Tax rules for US citizens (Guidelines) | Expat US Tax – #76

IRS Raising Annual Gift Tax and Estate Tax Exclusions in 2023 | Pierro, Connor, & Strauss, LLC. – #77

IRS Raising Annual Gift Tax and Estate Tax Exclusions in 2023 | Pierro, Connor, & Strauss, LLC. – #77

Gift Giving the Tax-Free Way – Littleton Legal – #78

Gift Giving the Tax-Free Way – Littleton Legal – #78

![No TDS u/s 194B on Prize won in Gift Coupons: ITAT [Read Order] | Taxscan No TDS u/s 194B on Prize won in Gift Coupons: ITAT [Read Order] | Taxscan](https://www.ustaxfiling.in/wp-content/uploads/2021/06/All-about-gifts-received-from-relatives-are-income-tax-free.jpg) No TDS u/s 194B on Prize won in Gift Coupons: ITAT [Read Order] | Taxscan – #79

No TDS u/s 194B on Prize won in Gift Coupons: ITAT [Read Order] | Taxscan – #79

Gift tax: what is it & how does it work? | Empower – #80

Gift tax: what is it & how does it work? | Empower – #80

Estate and Gift Taxes 2021-2022: What’s New This Year and What You Need to Know – WSJ – #81

Estate and Gift Taxes 2021-2022: What’s New This Year and What You Need to Know – WSJ – #81

Govt exempts investment trusts, ETFs from capital gains tax in GIFT City | Business Insider India – #82

Govt exempts investment trusts, ETFs from capital gains tax in GIFT City | Business Insider India – #82

Transferring Assets During Life – Funding for Potential Gift Tax Liability – #83

Transferring Assets During Life – Funding for Potential Gift Tax Liability – #83

NRI Gift Tax in India – Gift from NRI to Resident Indian or Vice Versa – myMoneySage Blog – #84

NRI Gift Tax in India – Gift from NRI to Resident Indian or Vice Versa – myMoneySage Blog – #84

What Are Estate and Gift Taxes and How Do They Work? – #85

What Are Estate and Gift Taxes and How Do They Work? – #85

Income tax on gifts: Gift received from relatives is tax free | Mint – #86

Income tax on gifts: Gift received from relatives is tax free | Mint – #86

Giving While Living: Do You Understand the Gift Tax? – #87

Giving While Living: Do You Understand the Gift Tax? – #87

TAX TREATMENT OF GIFTS RECEIVED IN DEEPAWALI ? – Kanoon For All – #88

TAX TREATMENT OF GIFTS RECEIVED IN DEEPAWALI ? – Kanoon For All – #88

How to calculate income tax on gifts from relatives? – #89

How to calculate income tax on gifts from relatives? – #89

Estate Tax Exemption Increased for 2024 – Anchin, Block & Anchin LLP – #90

Estate Tax Exemption Increased for 2024 – Anchin, Block & Anchin LLP – #90

Income tax – “GIFT” Taxability under Income Tax Act,… | Facebook – #91

Income tax – “GIFT” Taxability under Income Tax Act,… | Facebook – #91

Gift Tax | TikTok – #92

Gift Tax | TikTok – #92

Transfer by Gift deed is not taxable – Property lawyers in India – #93

Transfer by Gift deed is not taxable – Property lawyers in India – #93

Annual Gift Tax Exclusion: Use It or Lose It – AmeriEstate – #94

Annual Gift Tax Exclusion: Use It or Lose It – AmeriEstate – #94

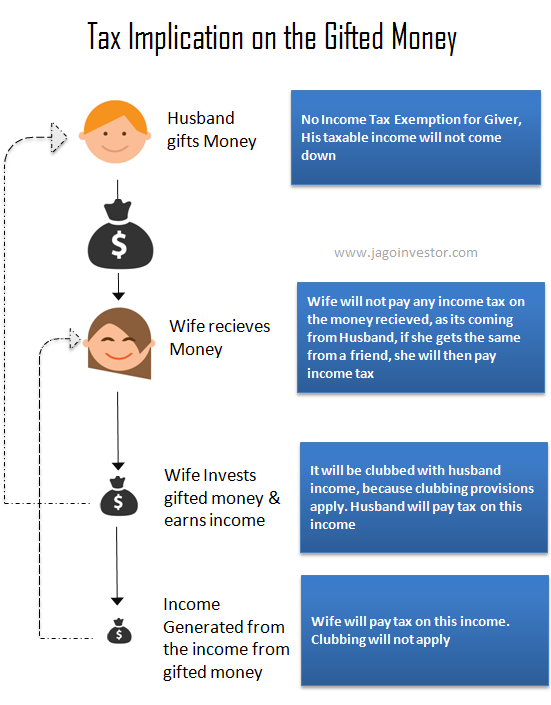

-originalImg-5d9c05bd-fef7-468b-a79a-7b00245b1da1.png) gift taxation: Which gifts are taxable for the recipient and which ones can increase tax liability of giver – The Economic Times – #95

gift taxation: Which gifts are taxable for the recipient and which ones can increase tax liability of giver – The Economic Times – #95

Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It – #96

Inheritance Tax: What It Is, How It’s Calculated, and Who Pays It – #96

2024 Annual Gift and Estate Tax Exemption Adjustments – #97

2024 Annual Gift and Estate Tax Exemption Adjustments – #97

Tax implications on gifts received at the occassion of Diwali – #98

Tax implications on gifts received at the occassion of Diwali – #98

Inheritance, Estate, and Gift Taxes in OECD Countries | Tax Foundation – #99

Inheritance, Estate, and Gift Taxes in OECD Countries | Tax Foundation – #99

How GIFT IFSC can encourage Indian startups to shift HQs back home – #100

How GIFT IFSC can encourage Indian startups to shift HQs back home – #100

Gift Tax 2023 | What It Is, Annual Limit, Lifetime Exemption, & Gift Tax Rate – #101

Gift Tax 2023 | What It Is, Annual Limit, Lifetime Exemption, & Gift Tax Rate – #101

Are Changes Coming to the Estate and Gift Tax? | Heritage Financial Services – #102

Are Changes Coming to the Estate and Gift Tax? | Heritage Financial Services – #102

Tax for NRIs on gifts of money and property from resident Indians received through gift deeds – Property lawyers in India – #103

Tax for NRIs on gifts of money and property from resident Indians received through gift deeds – Property lawyers in India – #103

Gift Under The Income Tax Act In India – Especia – #104

Gift Under The Income Tax Act In India – Especia – #104

Gift Tax – The new rules | BankBazaar – The Definitive Word on Personal Finance – #105

Gift Tax – The new rules | BankBazaar – The Definitive Word on Personal Finance – #105

Five Situations When Taxable Gifts Make Sense | Wealth Management – #106

Five Situations When Taxable Gifts Make Sense | Wealth Management – #106

- gift tax rate

- gift tax exclusion 2023

- form 709

Frequently Asked Questions on Gift Taxes | Internal Revenue Service – #107

Frequently Asked Questions on Gift Taxes | Internal Revenue Service – #107

- list of relatives

- gift tax rate 2023

- excise tax

- gift chart as per income tax

- gift tax act 1958

- gift tax upsc

Gift- Income Tax on Gift- Exempt Gift- Taxable Gift- Tax Planning with Gifts under Income Tax Act – YouTube – #108

Gift- Income Tax on Gift- Exempt Gift- Taxable Gift- Tax Planning with Gifts under Income Tax Act – YouTube – #108

Diwali Gift Tax Explained; List of Taxable and Non-Taxable Gifts In India | आपका बटुआ- क्या दिवाली बोनस पर देना पड़ता है टैक्स?: क्या कहता है कानून, दिवाली गिफ्ट का कितना हिस्सा – #109

Diwali Gift Tax Explained; List of Taxable and Non-Taxable Gifts In India | आपका बटुआ- क्या दिवाली बोनस पर देना पड़ता है टैक्स?: क्या कहता है कानून, दिवाली गिफ्ट का कितना हिस्सा – #109

Income Tax On Diwali Gifts – Omozing – #110

Income Tax On Diwali Gifts – Omozing – #110

What is taxation on Gifts | Investyadnya eBook – #111

What is taxation on Gifts | Investyadnya eBook – #111

Cash Gift to be taxed in year in which it was received and not in year it was Traced by Department – #112

Cash Gift to be taxed in year in which it was received and not in year it was Traced by Department – #112

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #113

Understanding Federal Estate and Gift Taxes | Congressional Budget Office – #113

Nri Gift Tax In India – #114

Nri Gift Tax In India – #114

When Is a Gift Complete for Tax Purposes? Pt 1 | Sharpe Group – #115

When Is a Gift Complete for Tax Purposes? Pt 1 | Sharpe Group – #115

Tax on Gifts in India: know taxation rules on gifts according to Income Tax Act 1961 | Business – #116

Tax on Gifts in India: know taxation rules on gifts according to Income Tax Act 1961 | Business – #116

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #117

The Gift Tax Made Simple – TurboTax Tax Tips & Videos – #117

Forums | Taxablity of gifts-dt – #118

Forums | Taxablity of gifts-dt – #118

Did You Know that Client Gifts are Tax Deductible? – #119

Did You Know that Client Gifts are Tax Deductible? – #119

Income Tax News: Understanding the Tax Implications on Monthly Transfers and Gift Money; Check The Guide Here – #120

Income Tax News: Understanding the Tax Implications on Monthly Transfers and Gift Money; Check The Guide Here – #120

-Gifts.jpg) Regulations Related to Gift Tax in India – #121

Regulations Related to Gift Tax in India – #121

Taxability of Gifts: Who Pays and How to Avoid Taxes – Picnic Tax – #122

Taxability of Gifts: Who Pays and How to Avoid Taxes – Picnic Tax – #122

How to Max Out the Gift Tax Exclusion – CPA Practice Advisor – #123

How to Max Out the Gift Tax Exclusion – CPA Practice Advisor – #123

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #124

How to Ensure Cash Gifts from Parents and Relatives Won’t Land you in Tax Trouble – #124

Exploring Sales Tax Implications of Gift Cards and Gift Certificates – #125

Exploring Sales Tax Implications of Gift Cards and Gift Certificates – #125

Tax On Gift Money | Income Tax On Gifts Received | Taxation Of Gifts Under Income Tax – YouTube – #126

Tax On Gift Money | Income Tax On Gifts Received | Taxation Of Gifts Under Income Tax – YouTube – #126

- gift tax rate in india 2020

- property tax

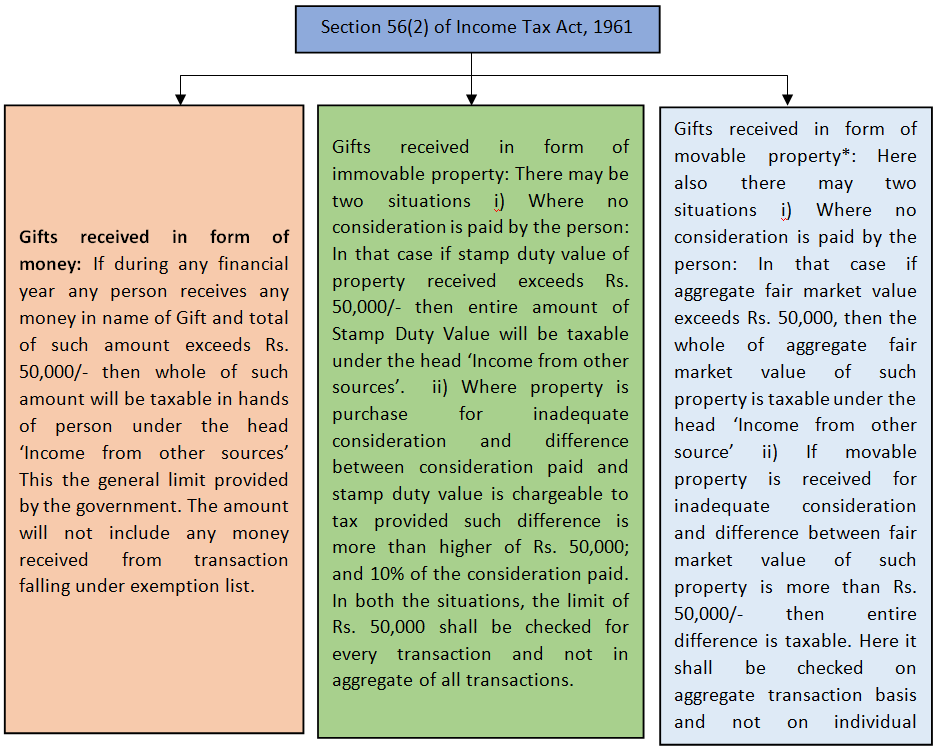

- section 56(2) of income tax act

Tax Relief – Just for Them Gift Baskets – #127

Tax Relief – Just for Them Gift Baskets – #127

Gift Tax Exclusion for 2023 and 2024 | Haynie & Company – #128

Gift Tax Exclusion for 2023 and 2024 | Haynie & Company – #128

Is There Gift Tax If I Give My Niece Money for Her IRA? | Money – #129

Is There Gift Tax If I Give My Niece Money for Her IRA? | Money – #129

How to Avoid the Gift Tax – SmartAsset | SmartAsset – #130

How to Avoid the Gift Tax – SmartAsset | SmartAsset – #130

Gifts from relatives are always tax-free – The Economic Times – #131

Gifts from relatives are always tax-free – The Economic Times – #131

Posts: taxability of gift

Categories: Gifts

Author: toyotabienhoa.edu.vn